Renters Insurance in and around Jefferson City

Jefferson City renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Home is home even if you are leasing it. And whether it's a house or a condo, protection for your personal belongings is a wise idea, especially if you could not afford to replace lost or damaged possessions.

Jefferson City renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Safeguard Your Personal Assets

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented townhome include a wide variety of things like your microwave, smartphone, TV, and more. That's why renters insurance can be such a good decision. But don't worry, State Farm agent Walker Kesterson has the efficiency and personal attention needed to help you evaluate your risks and help you protect your belongings.

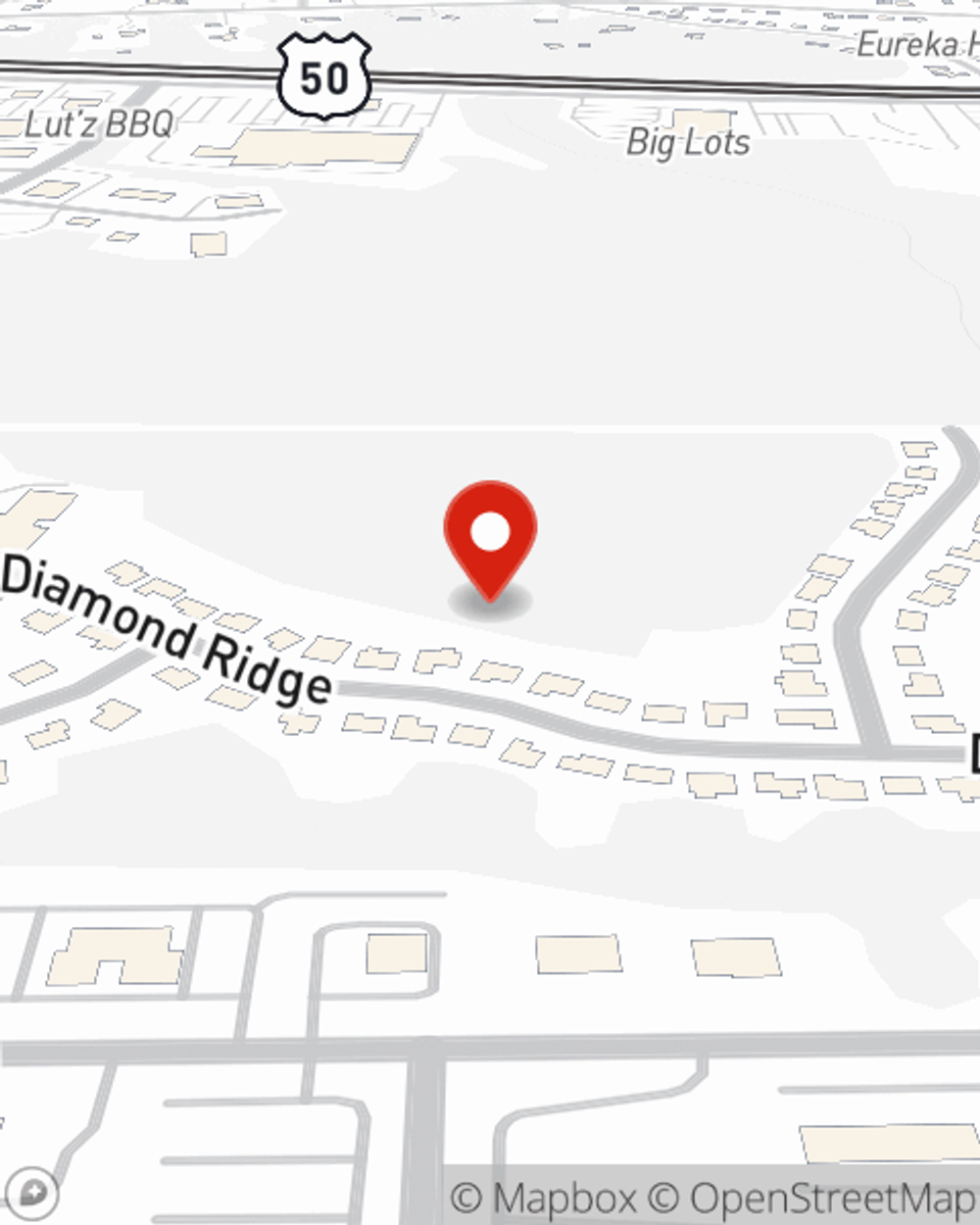

A good next step when renting a house in Jefferson City, MO is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online today and see how State Farm agent Walker Kesterson can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Walker at (573) 635-3500 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Walker Kesterson

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.